Mobile banking is a convenient way to deal with your finances anywhere at any time.

However, with this new banking technology comes many potential security risks which you may not have considered before signing up.

This guide has been compiled to make you aware of all the possible dangers so you can make the best-informed choice before using this new innovative service.

Technology

Gone are the days when you have to visit your branch to carry out your banking. Now you can access your accounts over the phone, on the internet – and from your mobile phone.

But these new services can present hazards which you need to be fully aware of if you use them.

Banking from your mobile

There are three main ways in which you can access your banking via your mobile phone:

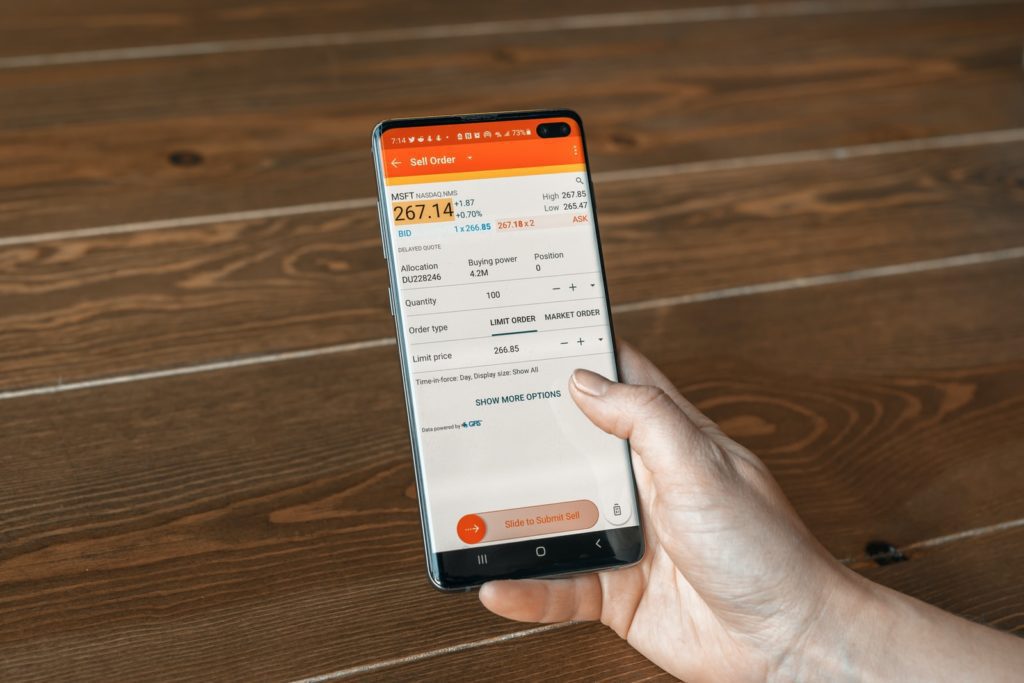

- By using your bank’s mobile website to log in to your current account and check your balance, statements, latest activity, organise payments, carry out transfers and more

- Download and use a bank’s app to do more unless the same as what you can do on the bank’s mobile website

- Receive text message alerts to notify you of your balance on a weekly basis, when you are near your overdraft limit and more

Warnings

The Financial Conduct Authority has recently warned against the possible dangers associated with mobile banking.

The organisation, which oversees the financial services industry in the UK, wants to help protect users against any conceivable problems which could arise when dealing with finances on a mobile phone, tablet computer or other device.

Dangers include using the service when you’re tired at night, which could lead to mistakes when making payments or transferring funds.

Other issues involve accounts being affected by IT problems and also, more worryingly, different types of crime.

Criminals wanting to steal from you will look for any available opportunity to gain access to your bank account. People who are lax about covering up what they’re doing, when using mobile banking, could be in jeopardy of displaying their passwords and PIN codes to the wrong crowd.

If your mobile is stolen, this could also be a chance for the thief in question to get into your account if security measures aren’t in place.

There’s also the risk of cyber crime. This involves thieves using computer technology to access people’s bank accounts through mobile devices by tapping them with viruses or fraudulent software. This could also lead to the theft of personal information.

Make it safe

Ultimately, it is down to you to keep your mobile banking protected.

It is important to concentrate when using this service, as well as being savvy to who is around you and keeping what you are doing as private as possible – just like when you’re tapping your PIN number into the cash machine outside in the street or at a shop.

Also, be mindful about what you download onto your phone and be conscious of the fact that hackers are out there targeting those who use online banking. You should consider using anti-virus software.

If you follow all precautions and stay vigilant, you can make the most of the benefits mobile banking has to offer.